For you use, at least as I understand it, it seems to be incorrect.Īs I understand from your question and comment, you are trying to do anomaly detection.

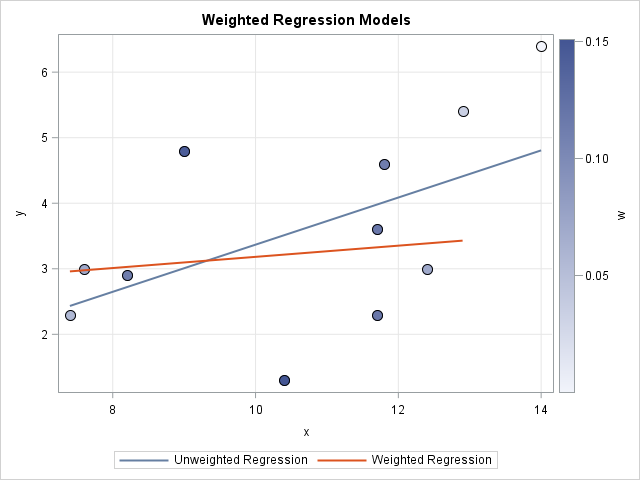

Alternatives determining spread and central tendency for percentages over a period of time.įor example, would the following be incorrect to do assuming that the percentages represent # transactions missed / # total transactions for each different months with the same calculation being used for each month: Month Dataįrom this post is seems like it should be done with weighted averages since the totals are different, and that calculating the mean and standard deviation is possible for percentages only if they come from the same total, meaning the above would be incorrect and that I would need additional information to determine the weight to multiple the percentages by, if that is correct.Īs others have pointed out, whether it is correct to calculate the mean and the standard deviation of percentages depends on your intended use.What conditions are needed in order to calculate the mean and standard deviation for percentages,.If the mean and standard deviation for percentages can be calculated,.some other method (weighted averaged) since I do not have any other information other than the percentages. I was asked to calculate the mean and standard deviation, but I am unsure if the result would be meaningful and if the mean could be calculated for percentages in the traditional sense (e.g., in Excel doing AVERAGE(percent array)) vs. The percentages are for 13 months and ranging from 97 to 99 percent.

It works best in mid to long term sideways channels / Wyckoff accumulation periods.My data is some percentages on how many transactions from a whole are missed each month. It trades when price lows crossunder the bottom of that deviation channel, and sells when price highs crossover the top of that deviation channel. It recalculates each time a new candle is printed. It calculates a weighted standard deviation of the price for the lookback period set (so 20 candles is default). It also already accounts for the commission percentage of 0.075% that Binance.US uses for people who pay fees with BNB. If you do, I ask that you please share the script with the community in an open-source fashion. An experienced pinescript programmer can take this and build on it even more. They are.ġ) Lookback Length - I have had luck with it set to 20, but any value from 1-1000 it will accept.Ģ) stopPer - Stop Loss percentage of each tradeģ) takePer - Take Profit percentage of each tradeĢ and 3 above are where you will see significant changes in returns by altering them and trying different percentages. These 3 things are what the end user should tweak for optimum returns. It is a standard deviation script that has 3 important user configured parameters. 15 minute time frame has worked best for me. This script isn't a life changer, but it has the building blocks for a motivated individual to optimize the parameters and have a production script ready to go.Ĭredit for the indicator is due to adapted this indicator to a strategy for crypto markets. As I progress through my journey, I have come to the realization that it is time to give back.

0 kommentar(er)

0 kommentar(er)